Qhathanisa iphepha nemishini yokupakisha yepulasitiki ukuze uhambisane, ukuqina, i-ROI, kanye nokufaka uphawu. Funda imininingwane yochwepheshe, izifundo zezenzakalo, kanye nedatha ukuze unqume ukuthi yisiphi isisombululo esifanelana kangcono nemigomo yakho yokuhleleka nokusimama.

Isifinyezo Esisheshayo: "Ingabe imishini yokupakisha iphepha ikufanele ngempela ukutshalwa kwezimali ngo-2025?" Cabanga ngalo mbuzo ebhodini lapho abaphathi bezokuthutha, izikhulu zokusimama, nama-CFO bedingida izindleko zabo ezinkulu ezilandelayo. Ngakolunye uhlangothi, izinhlelo zephepha zithembisa ukuphinda zisetshenziswe, ukuthobela i-ESG, kanye nokufakwa uphawu kweprimiyamu; ngakolunye, imishini yepulasitiki inikeza ukuqina, i-cushioning efakazelwe, kanye nesivinini. Lesi sihloko sihlola kokubili, siqhathanisa ukusebenza kwakho kukho konke ukuthobela, ukuqina, i-ROI, nevelu yomkhiqizo, futhi sigqamisa ukuthi kungani ukukhetha okulungile kuncike emikhiqizweni yakho, emigomeni yochungechunge lokunikezela, kanye nokulindelwe yikhasimende.

Ingxoxo Yomhlaba Wangempela

Umqondisi Wokusebenza: "Singaphansi kwengcindezi yokusika amapulasitiki, sihlangabezane nokuthobela imithetho, futhi sehlise izindleko zempahla. Kodwa imishini emisha ayishibhile. Ingabe imishini yokupakisha amaphepha ikufanele ngempela ukutshalwa imali?"

Unjiniyela Wokupakisha: "Cabanga ngakho njengokuthuthukisa ikhaya lakho. Uma ukhetha izinto ezihlala isikhathi eside, ezithobela imvelo, awuthuthukisi nje ukunethezeka-wengeza inani lesikhathi eside. Imishini yokupakisha yamaphepha yenza okufanayo ochungechungeni lwakho lokuhlinzeka. Yehlisa isisindo sobukhulu (DIM), iqinisekisa ukuphinda isetshenziswe, futhi izuza ukwethenjwa kwamakhasimende."

I-CFO: "Kodwa sazi kanjani ukuthi akuyona nje i-greenwashing?"

Unjiniyela: "Imithetho iyaqina. I-EU PPWR, i-U.S. EPR, kanye nokushintsha kwe-Amazon ka-2024 ekubhekeni kwephepha kubonisa ukuthi akuyona inketho. Umbuzo wangempela uthi: singakwazi yini ukukhokhela hhayi ukutshala imali?”

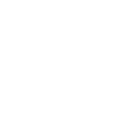

Isikhwama Sephepha Nomshini Wokwenza Imeyili

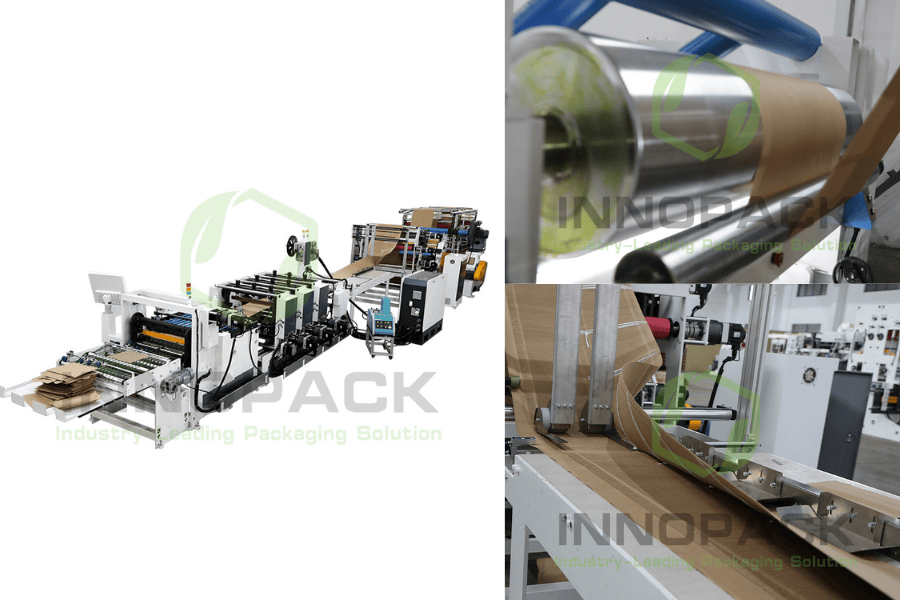

Ukuqhathanisa Iphepha vs Imishini Yokupakisha Yepulasitiki

| Imibandela | Imishini Yokufaka Amaphepha | Imishini Yokupakisha Yepulasitiki |

| Ukuhambisana | Ingaphinde isetshenziswe ngokwemvelo; ihambisana ne-PPWR/EPR; kulula ukubhala ukusebenza kokusimama. | Ikhiqiza ama-PE cushions we-mono-material; ingasetshenziswa kabusha uma iklanywe ngendlela efanele; izitifiketi zokuhlola ziyatholakala. |

| Ukuqina | Ukugoqa okuqinisiwe kanye nemithungo kubambe umumo, kumelane nama-scuffs namashaji e-DIM ngesikhathi sokuthutha. | Ukumuncwa komthelela okuhle kakhulu; ilungele imikhiqizo entekenteke noma ebukhali edinga ukuvikeleka okuqinile. |

| Inani lomkhiqizo | Ukuxoxwa kwezindaba “okungenapulasitiki” kusekela imigomo ye-ESG futhi kuthuthukise ukwenziwa kwebhrendi okuyi-premium, eco-friendly. | Uthenjwa ngokwethembeka nokungaguquguquki; ibaluleke kakhulu kuzo zonke izimboni ebeka phambili ukuphepha komkhiqizo. |

| Ukulungela Ukucwaningwa Kwamabhuku | Izimemezelo zamahhala ze-PFAS kanye nemibhalo egaywa kabusha yenza kube lula ukubika ukuthobela. | Amasistimu athuthukile ahlinzeka ngamalogi enqwaba, ukulandeleka, kanye nezitifiketi zokulungela ukuhlolwa. |

| ROI Abashayeli | Yehlisa izindleko zempahla, izimbuyiselo ezimbalwa, ukuthobela imithetho eqinile, inani lempahla lesikhathi eside. | Ukuphuma okuphezulu, ukucushwa okuqinisekisiwe, ukusebenza kahle emisebenzini emikhulu, i-ROI eqinile yesikhathi esifushane. |

Izinto kanye Nokukhethwa: Kungani Imishini Yokupakisha Iphepha I-Excels

Iphepha Lengilazi

I-Smooth, iguquguqukayo, imelana namafutha ngaphandle kwe-PFAS. Ilungele abathumeli be-premium ababukeka be-eco-luxurious kuyilapho begaywa kabusha.

Iphepha le-Kraft

Iqinile, ithembekile, yamukelwe kabanzi ekugayweni kabusha kwe-curbside. Ilungele amaphedi nama-cushions ahlanganisa imikhiqizo.

I-Fan-Fold Technology

Igcina ukunemba nokuqina kuzo zonke izinkathi ezinde. Amasistimu ethu anqanda ama-curl nama-seam drift, okuqinisekisa ikhwalithi engashintshi.

Kungani kungcono: Imigqa evamile idonsa kanzima ngamamaki amancane kanye nephepha elincishisiwe. Umshini wethu Wokufaka Amaphepha usebenzisa i-servo-driven, ukuvalwa kwe-loop, nokuhlola okungaphakathi komugqa ukuze kuqinisekiswe ukuzinza ngisho nangesivinini esikhulu.

Ubunjiniyela Nenqubo: Sikuletha Kanjani Ukuqina kanye ne-ROI

I-Servo Web Control: Igcina ukungezwani okuphelele kwamaphepha athambile.

Ukuvala iluphu evaliwe: Iqinisekisa ukuthi ama-seams abamba ngaphansi komthwalo nangesikhathi sokuthutha.

I-Inline Vision Systems: Thola izikhala ze-seam, i-skew, nezinkinga ngesikhathi sangempela.

Audit-Ready Batch Logs: Ithekelisa ngamafomethi e-CSV/API emaqenjini okuthobelana.

I-Operator-Centric HMIs: Ukushintshashintsha okwenziwe lula kunciphisa isikhathi sokuphumula.

Umphumela: Izimbuyiselo ezimbalwa, ukudlula okusheshayo, i-OEE ethuthukisiwe (Ukusebenza Sezisetshenziswa Sekukonke), kanye ne-ROI eqinile.

Ulwazi Lochwepheshe

U-Sarah Lin, Amathrendi we-ArchDaily (2024):

"Imishini yokupakisha yamaphepha ihambisana nomnyakazo womhlaba wonke obheke ekuvinjelweni kwepulasitiki. Izinkampani eziwusebenzisa ngokunenzuzo umkhiqizo ngokushesha."

👉 Ucwaningo lukaSarah Lin lubonisa ukuthi abamukeli bokuqala bemishini esimeme abagcini nje ngokuhlangabezana nokuhambisana kodwa futhi bayazuza izinzuzo zokubeka uphawu lokuqala, ikakhulukazi kwezokudayisa kanye ne-e-commerce. Amakhasimende aya ngokuya ewazisa amabhrendi asebenzayo, angasebenzi, mayelana nokusungula izinto ezintsha.

UDkt. Emily Carter, MIT Materials Lab (2023):

"I-Glassine ne-kraft, uma icutshungulwa ngaphansi kwemishini elawulwa yi-servo, ifinyelela ukusebenza ngokulingana nama-cushions epulasitiki ekuhlolweni kokuqina."

👉 Izilingo zokuqina zikaDkt. Carter ziqhathaniswa I-Edge crush resistance (ECT) futhi qhuma amandla wephepha vs amakhushini epulasitiki. Iphepha lithole u-92–95% wamabhentshimakhi okuqina afanayo, okufakazela lokho ubunjiniyela obufanele buvala igebe lokusebenza phakathi kwezinto zokwakha.

Umbiko Womkhakha we-PMMI (2024):

Ukuthunyelwa kwemishini yokupakisha kudlule u-$10.9B, ngamasistimu asekelwe ephepheni amele isigaba esikhula ngokushesha.

👉 Ngokusho kwe-PMMI, ukutshalwa kwezimali ku amasistimu wokupakisha amaphepha akhule ngo-17% unyaka nonyaka, uma kuqhathaniswa nokukhula okungu-6% ezinhlelweni ezigxile epulasitiki. Lokhu kukhombisa umfutho wokulawula, isidingo sabathengi, kanye nokugudlukela ezinkontilekeni zokuthenga izixazululo ze-eco-certified.

Idatha Yesayensi

-

Umbiko wokupakisha we-EU (2023):

U-85% wabathengi uncamela ukupakishwa okungagaywa kabusha; Ama-62% ahlobanisa abathumeli bephepha nemikhiqizo ephambili.

👉 Lokhu kugqamisa ukuthi ukutshalwa kwezimali kwemishini yamaphepha kuhlangana kanjani ngqo ukuziphatha kokuthenga kwabathengi. Ukupakisha akusebenzi nje kuphela—kunomthelela umbono womkhiqizo bese uphinda inhloso yokuthenga.

-

Isifundo se-EPA (2024):

Iziqukathi nokupakishwa kwakha umfudlana omkhulu kamasipala wemfucuza—uphelile 82 million amathani ngonyaka. Amazinga okugaya amaphepha adlula 68%, kuyilapho amapulasitiki ehlala ngaphansi 10% ezifundeni eziningi.

👉 Lesi sikhala sichaza ukuthi kungani abenzi benqubomgomo bephusha iziyalezo zephepha-kuqala, okwenza imishini yephepha ibe ukubheja okuphephile kwe-ROI yesikhathi eside.

-

Ijenali ye-Sustainable Logistics (2023):

Ukushintsha kusuka epulasitiki kuya ephepheni kuncishisiwe Izindleko zesisindo se-DIM zingafika ku-14%.

👉 Ucwaningo lwe-logistics luphinde lwaphawula ukuthi amaphedi amaphepha avumelekile ukusebenza kahle kwe-palletization, kunciphisa isikhala sesitsha esimoshekile. Lokho kunomthelela ngqo izindleko zempahla kanye nokukhishwa kwekhabhoni.

I-Case Studies kanye Nezicelo Zangempela

1. Izimpahla Ze-E-Commerce

-

Inselelo: Abathumeli beposi bepulasitiki babangele izikhalazo zomkhiqizo (“ukubukeka okushibhile”) futhi baheha izinhlawulo ze-DIM.

-

Isixazululo: Shintshela kuma-mailers engilazi anezithungo ezivalwe nge-servo.

-

Umphumela:

-

18% imbuyiselo embalwa evela ezimpahleni ezilahliwe.

-

Umjikelezo wokupakisha osheshayo ongu-25% ngenxa yokuphakelayo okuzenzakalelayo.

-

Izibuyekezo zekhasimende ezithuthukisiwe ezicaphuna "umuzwa we-unboxing we-eco-friendly."

2. Umsabalalisi Wezincwadi

3. Izesekeli zikagesi

-

Inselelo: Ama-SKU antekenteke njengama-headphone namashaja avame ukugqekeza kwezokuthutha.

-

Isixazululo: Imodeli yokupakisha eyiHybrid: amakhushini ephepha ama-SKU ajwayelekile, amakholomu epulasitiki wezinto ezintekenteke zenani eliphezulu.

-

Umphumela:

-

Izimangalo zomonakalo zehle ngo-21%.

-

Isikolo se-ESG sithuthukile, okwenza inkampani ikwazi ukuwina i-a inkontileka enkulu yokudayisa.

-

Ukhombise lokho iphepha nepulasitiki kungahlala ndawonye ngamasu.

Impendulo yomsebenzisi

-

Umphathi Wezinto Zokusebenza:

"Sinciphise izindleko ze-DIM ngamadijithi aphindwe kabili phakathi nekota yokuqala. Okungimangaze kakhulu ukuthi ukongiwa kwavela ngokushesha kangakanani-i-CFO yethu ibingayidingi imodeli ye-ROI yezinyanga eziyi-12; izinombolo zazizikhulumela ngokwazo."

-

Inhloko Yezokusebenza:

"Ukwehluleka komthungo kwanyamalala ngemuva kokwamukela imigqa yephepha eshayelwa i-servo. Ngepulasitiki, besinezicucu ezinesici esingama-3-5%. Manje, isikhathi sokusebenza sesiphezulu, futhi i-scrap icishe ibe yinto engasho lutho. Lokho kusho ukusebenza kabusha okuncane kanye namashifu ashelelayo."

-

Umqondisi Wokuthobela

"Ucwaningomabhuku manje luphela ngezinsuku, hhayi amasonto. Amalogi eqoqo akhiqizwa umshini wokupakisha wamaphepha ahambisana kahle ne-PPWR kanye nezinhlu zokuhlola zabathengisi. Kithina, ukulungela ukuhlola kubaluleke kakhulu njengokulondoloza impahla."

Abahlinzeki Bemishini Yokupakisha Amaphepha

FAQ

1. Ingabe imishini yokupakisha iphepha ihlala isikhathi eside ngokwanele?

Yebo, ngokugoqa okuqinisiwe nokuvala iluphu evaliwe, kufana nezinhlelo eziningi zepulasitiki.

2. Ingabe ithuthukisa i-ROI?

Yebo. Ukongiwa kuvela ekuncishisweni kwempahla, izimbuyiselo ezimbalwa, nokuhlolwa kwamabhuku okusheshayo.

3. Ingabe indawo eyodwa ingasebenzisa imishini yephepha neyepulasitiki?

Yebo. Izitshalo eziningi zisebenzisa iphepha kuma-SKU amaningi kodwa zigcina amaseli epulasitiki ezimpahla ezicijile noma ezintekenteke.

4. Ingabe amakhasimende azokhetha iphepha?

Uhlolovo lukhombisa u-85% wabathengi bahlobanisa abathumeli bephepha ne-eco-premium branding.

5. Yiziphi izimboni ezizuza kakhulu?

I-E-commerce, izingubo zokugqoka, izincwadi, izimonyo, nemikhiqizo ye-FMCG eqondise emigomweni ye-ESG.

Izithenjwa

-

I-European Commission - I-Packaging and Packaging Waste Regulation (PPWR)

-

PMMI - Umbiko Wesimo Semboni wango-2024

-

Igumbi lezindaba lase-Amazon - I-Plastic-Free Packaging Milestone

-

I-U.S. EPA - Iziqukathi Nokupakishwa: Umbiko we-MSW 2024

-

UNEP - Ivala i-Tap: Umbiko Wokungcoliswa Kwepulasitiki wango-2023

-

DS Smith - Izimo zengqondo zabathengi ocwaningweni lokupakisha

-

I-ArchDaily - Amathrendi ku-Sustainable Packaging Design

-

I-MIT Materials Lab - Ukuhlolwa kokusebenza kwe-Glassine namaphepha e-Kraft

-

Ijenali ye-Sustainable Logistics — I-DIM Ukunciphisa Isisindo Ngokufaka Iphepha

-

McKinsey - Ukupakisha i-ESG Outlook 2025

Ekuhlaziyeni kokugcina, yomibili imishini yokupakisha yamaphepha neyepulasitiki iyaqhubeka nokudlala indima ebalulekile ekuphatheni komhlaba wonke. Ochwepheshe bayavuma ukuthi izinqumo zokutshalwa kwezimali aziphathelene nokuqeda inketho eyodwa kodwa zimayelana nokuqondanisa imishini nezidingo ezithile zomugqa womkhiqizo ngamunye. Njengoba u-Sarah Lin (ArchDaily Trends, 2024) aphawula, imishini yephepha isekela ukuthotshelwa kwemithetho kanye nokuxoxwa kwezindaba ngomkhiqizo, kuyilapho uDkt. Emily Carter (MIT Materials Lab, 2023) egcizelela ukuthi i-durability system ye-paper-drive manje igcizelele ukuthi amasistimu e-paper driven. Imibiko yemboni iqinisekisa ukukhula kuyo yomibili le mikhakha, njengoba iphepha likhula ngamandla ngaphansi kwegunya lokusimama kanye nokuhambisana nokugcinwa kwepulasitiki ezimpahleni ezintekenteke.

Ezinkampanini, isu elingcono kakhulu alikona “noma/noma” kodwa “lifanele inhloso.” Ukwamukela imishini yephepha kuthuthukisa i-ESG futhi kunciphisa izindleko ze-DIM, kuyilapho ukugcinwa kwezinhlelo zepulasitiki ezikhethiwe kuqinisekisa ukuvikeleka kwezinto ezibucayi. Le ndlela elinganiselayo iqinisa ukuthobela, ukwaneliseka kwamakhasimende, kanye ne-ROI yesikhathi eside, okwenza ukutshalwa kwezimali kwemishini kube insika yesu lokupakisha ngo-2025 nangale kwalokho.