ស្វែងយល់ពីភាពខុសគ្នាសំខាន់ៗរវាងម៉ាស៊ីនបត់ និងម៉ាស៊ីនសំបុត្រនៅឆ្នាំ 2025។ ស្វែងយល់ពី ROI ភាពធន់ និរន្តរភាព និងប្រសិទ្ធភាពស្វ័យប្រវត្តិកម្ម។ ស្វែងយល់ពីរបៀបដែល Innopack Machinery ជួយក្រុមហ៊ុនផលិតទូទាំងពិភពលោកឱ្យសម្រេចបាននូវដំណោះស្រាយវេចខ្ចប់កាន់តែឆ្លាតវៃ បៃតង និងលឿនជាងមុន។

សង្ខេបខ្លីៗ៖ ប្រសិនបើអ្នកដឹកជញ្ជូនប្រអប់ សៀវភៅ សម្លៀកបំពាក់ ឬក្បាលដីពាណិជ្ជកម្មតាមប្រព័ន្ធអេឡិចត្រូនិចតាមខ្នាត អ្នកទំនងជាកំពុងសម្រេចចិត្តរវាងម៉ាស៊ីនបត់ (សម្រាប់បត់/ផ្នត់/ស្អិតក្រដាស ឬស្រទាប់ខាងក្រោម kraft ចូលទៅក្នុងប្រអប់ សិលាចារឹក និងសំប៉ែត) និងម៉ាស៊ីន Mailer (សម្រាប់ផលិត ឬដាក់ថង់ក្រដាសដោយស្វ័យប្រវត្តិ)។ មគ្គុទ្ទេសក៍នេះប្រៀបធៀប ROI, ធន់, ឆ្លងកាត់, និរន្តរភាព, និងសមតាមគោលបំណង - បន្ទាប់មកបង្ហាញកន្លែងដែលម៉ាស៊ីននីមួយៗឈ្នះសម្រាប់ SKUs និងផែនការកំណើនខុសៗគ្នា។

ការសន្ទនាពិតប្រាកដ អ្នកដឹកនាំប្រតិបត្តិការ៖ "ថ្លៃដឹកជញ្ជូនរបស់យើងបន្តកើនឡើង។ ថ្លៃថ្លឹងទម្ងន់គឺឃោរឃៅ។ តើយើងគួរប្តូរចេញពីកេសធំឬ?"

វិស្វករវេចខ្ចប់៖ "ផ្លូវពីរ៖ វិនិយោគលើភាពជាក់លាក់ខ្ពស់។ ម៉ាស៊ីនបត់ ទៅប្រអប់ទំហំខាងស្ដាំនិងការបញ្ចូល — ឬទៅជាមួយ a ម៉ាស៊ីនសំបុត្រ ដើម្បីផ្លាស់ទី SKUs បន្ថែមទៀតចូលទៅក្នុងសំបុត្រក្រដាស។ ទាំងពីរអាចកាត់បន្ថយថ្លៃសេវា DIM; តើមួយណាសងវិញបានលឿនជាង អាស្រ័យលើផលិតផលចម្រុះ ផែនការស្រទាប់ខាងក្រោម និងគោលដៅនៃពេលវេលាដំណើរការរបស់អ្នក។"

CFO៖ "បន្ទាប់មកផ្តល់ឱ្យខ្ញុំនូវការពិត: ជួរវិនិយោគ ទិន្នផលក្នុងមួយម៉ោង ភាពធន់ និងរបៀបដែលវាធ្វើអោយប្រសើរឡើងនូវនិរន្តរភាព - ដោយមិនបន្ថយល្បឿន។"

វិស្វករ៖ "កិច្ចព្រមព្រៀង។ ចូរប្រៀបធៀបដោយល្បឿន ស្រទាប់ខាងក្រោម កម្លាំងពលកម្ម OEE និងអ្វីដែលសំខាន់ចំពោះអ្នកដឹកជញ្ជូនឆ្នាំ 2025។"

ម៉ាស៊ីនសំបុត្រ

ម៉ាស៊ីនបត់ទល់នឹងម៉ាស៊ីន Mailer - មើលមួយភ្លែត កញ្ចក់ការសម្រេចចិត្ត ម៉ាស៊ីនបត់ ម៉ាស៊ីនសំបុត្រ ទិន្នផលបឋម ប្រអប់ក្រដាស់បត់, ដៃអាវ, សិលាចារឹក, ផ្ទះល្វែងពាណិជ្ជកម្មអេឡិចត្រូនិច ប្រអប់សំបុត្រក្រដាស (ត្រាដោយខ្លួនឯង) ថង់ក្រដាសបិទភ្ជាប់ បញ្ចូលដោយស្វ័យប្រវត្តិ ល្អបំផុតសម្រាប់ SKUs ត្រូវការ រចនាសម្ព័ន្ធ (ផុយស្រួយ អាចជង់បាន លក់រាយ-ត្រៀមរួចរាល់) ទំនិញទន់ សំលៀកបំពាក់ សៀវភៅ គ្រឿងអេឡិចត្រូនិចតូច D2C ឆ្លងកាត់ ខ្ពស់; ជាញឹកញាប់រួមបញ្ចូលជាមួយ creasing/gluing (line-balanced) ខ្ពស់ណាស់សម្រាប់ទំហំស្តង់ដារ; ការផ្លាស់ប្តូររហ័ស ស្រទាប់ខាងក្រោម SBS / CCNB / ក្តារក្រដាស kraft ស្រទាប់កែឆ្នៃ របាំងពិសេស Kraft + ជាតិសរសៃកែច្នៃ, បន្ទះក្រដាស , អ្នកផ្ញើសំបុត្រដែលអាចប្រើឡើងវិញបាន។ អ្នកបើកបរចំណាយ ថ្នាក់ក្តារ, កាវ, ឧបករណ៍កាត់ផ្តាច់, ពេលវេលាផ្លាស់ប្តូរ ក្រដាស់ក្រដាស ក្រដាសបិទភ្ជាប់ ក្រដាសបិទភ្ជាប់ ទំងន់ DIM ក្រដាសកាតុងធ្វើកេសស្តាំ កាត់បន្ថយទំងន់វិមាត្រអ្នកផ្ញើប្រវត្តិរូបស្តើង កាត់បន្ថយចន្លោះទទេ & ថ្លៃបន្ថែម ធន់ ជង់ដ៏អស្ចារ្យ & កំទេចគែម; គំរូ QC ការការពារគ្រប់គ្រាន់សម្រាប់ SKUs មិនផុយស្រួយ; បន្ថែមការបញ្ចូលប្រសិនបើចាំបាច់ និរន្តរភាព សរសៃកែច្នៃយ៉ាងទូលំទូលាយ; ធ្វើការជាមួយមាតិកា PCR តម្រឹមជាមួយវេទិកាអ្នកលក់រាយរុញទៅ អ្នកផ្ញើក្រដាស ចន្លោះជាន់ ធំជាង (ចំណី + បត់ + កាវ + QC) ជាធម្មតាស្នាមជើងតូចជាង លំនាំសងត្រលប់ ខ្លាំងនៅពេលអ្នកលក់ច្រើន។ ប្រអប់ SKUs; ការលក់រាយឈ្នះ លឿននៅពេលផ្ទេរ SKUs ពីប្រអប់ទៅ អ្នកផ្ញើក្រដាស តើអ្នកណាគួរជ្រើសរើស ម៉ាកដែលត្រូវការវត្តមានធ្នើរលក់រាយ/ប្រអប់ដែលមានតម្លៃថ្លៃ ការដឹកជញ្ជូនទំនិញតាមអ៊ីនធឺណែតដែលមានបរិមាណខ្ពស់ ពន្លឺ/ទំនិញទន់

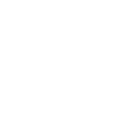

តើម៉ាស៊ីនបត់គឺជាអ្វី? A ម៉ាស៊ីនបត់ យកក្តារក្រដាសឬក្រដាស kraft និង ផ្នត់ ផ្នត់ និងកាវ ពួកវាចូលទៅក្នុងក្រដាសកាតុងធ្វើកេស ដៃអាវ ឬការបញ្ចូល។ នៅក្នុងប្លង់ទំនើប វាភ្ជាប់ចរន្តទឹក (ការចិញ្ចឹមសន្លឹក/រមៀល និងកាត់ផ្តាច់) និងចុះក្រោម (ម៉ាស៊ីនថត QC, បាកូដ/ព្រីន និងប៉ាឡែត) បង្កើតជាកោសិកាបំប្លែងដែលមានតុល្យភាព។ រង្វាស់គោលដៅ៖ ធរណីមាត្រដែលអាចធ្វើម្តងទៀតបាន។ , fisheyes តិចតួចបំផុត / និទាឃរដូវត្រឡប់មកវិញ, កម្លាំងចំណងខ្ពស់, និង ការផ្លាស់ប្តូរខ្លី សម្រាប់ Multi-SKU e-commerce ។

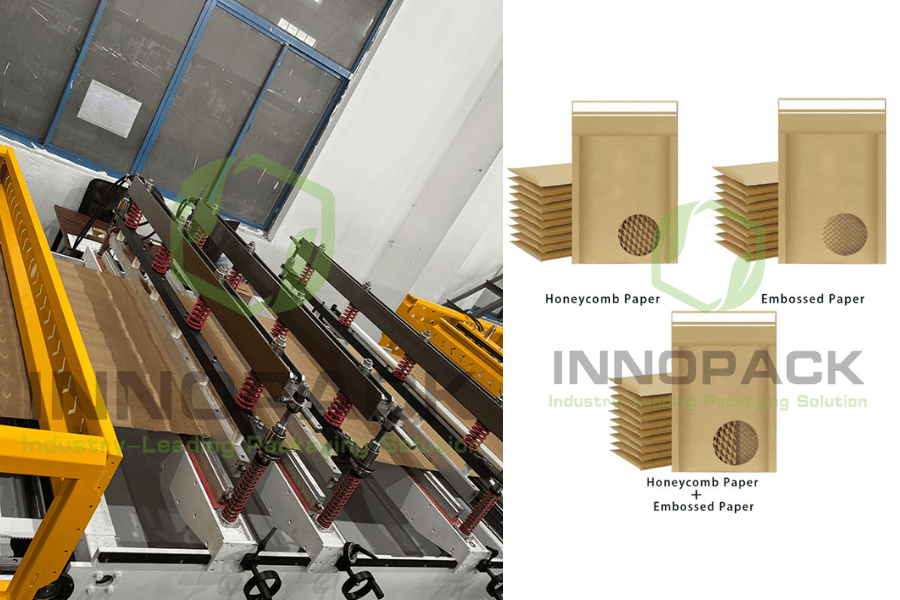

តើម៉ាស៊ីន Mailer ជាអ្វី? A ម៉ាស៊ីនសំបុត្រ បង្កើតជា kraft ឬ ក្រដាស padded អ្នកផ្ញើសំបុត្រ (ឬផ្តល់ព័ត៌មានអ្នកផ្ញើសំបុត្រដែលផលិតជាមុន) អនុវត្តការបិទសំបក និងបិទជិត ហើយជារឿយៗ ការបញ្ចូលដោយស្វ័យប្រវត្តិ ផលិតផល + ខ្ចប់ខ្ចប់។ ជាមួយនឹងទំហំស្ដង់ដារ និងការផ្លាស់ប្តូរទ្រង់ទ្រាយរហ័ស វាល្អសម្រាប់សម្លៀកបំពាក់ សៀវភៅ និងផ្នែកជំនួសតូចៗ—ស្តើង ស្រាល អាចកែច្នៃឡើងវិញបាន។ ក្បាលដីដែលគេចពី DIM បញ្ចូលទឹកប្រាក់បានយ៉ាងងាយស្រួលជាងប្រអប់សំពីងសំពោង។

នៅខាងក្នុង Innopack's ម៉ាស៊ីនបត់ សម្ភារៈដែលយើងបង្កើនប្រសិទ្ធភាព SBS / FBB / CCNB / Kraft liners ជាមួយ calipers ជាក់លាក់សម្រាប់ crease memory និង ECT គោលដៅ។

ក្តារក្រដាស PCR ខ្ពស់។ ជម្រើសដែលបានគាំទ្រ; លំនាំកាវត្រូវបានកែសម្រួលសម្រាប់ porosity សរសៃដែលកែច្នៃឡើងវិញ។

អាហារប៉ះឬថ្នាំកូតប្រឆាំងនឹងការច្រេះ ឆបគ្នាជាមួយសារធាតុស្អិតដែលរលាយក្តៅ និងទឹក

ដំណើរការផលិត (ពីទទេទៅប្រអប់) ការចិញ្ចឹម និងចុះឈ្មោះច្បាស់លាស់ - ការតម្រឹមដែលជំរុញដោយ servo កាត់បន្ថយការរអិល និងការបត់តូច។

ភាពវៃឆ្លាត - សម្ពាធពិន្ទុដែលអាចលៃតម្រូវបានដោយផ្លូវ; អង្គចងចាំបត់ជាប់គ្នាលើមាតិកាដែលបានកែច្នៃឡើងវិញ។

ការដាក់ពាក្យ និងការផ្ទៀងផ្ទាត់ - ការគ្រប់គ្រងលំនាំជាមួយនឹងការបញ្ជាក់កាមេរ៉ា; បដិសេធដោយឯកឯងដោយស្វ័យប្រវត្តិ។

ការបង្ហាប់និងការព្យាបាល - ខ្សែក្រវាត់បង្ហាប់ដែលគ្រប់គ្រងដោយពេលវេលាសម្រាប់ភាពសុចរិតនៃចំណង។

QA នៅក្នុងបន្ទាត់ - ចក្ខុវិស័យសម្រាប់មុំលឺផ្លឹបឭ កាវច្របាច់ចេញ និងវត្តមានកូដ។ ទិន្នន័យបានចូល MES ។

អ្វីដែលធ្វើឱ្យវាប្រសើរជាង "ធម្មតា" ការអត់ធ្មត់កាន់តែខ្លាំង ៖ ធ្វើការឡើងវិញតិចជាងលើការតម្រឹមផ្លុំ គែមស្អាតជាង (ការមិនដាក់ប្រអប់ពិសេស)។

ការផ្លាស់ប្តូរលឿនជាងមុន ៖ ការប្រមូលទម្រង់ផ្អែកលើរូបមន្ត; មគ្គុទ្ទេសក៍និងក្បាលកាវបិទដាក់ទីតាំងដោយស្វ័យប្រវត្តិ។

OEE ខ្ពស់ជាង ៖ ការជូនដំណឹងដែលព្យាករណ៍អំពីការកកស្ទះ & សីតុណ្ហភាពកាវ និង ការធ្វើរោគវិនិច្ឆ័យពីចម្ងាយ ដើម្បីបង្រួម MTTR ។

បញ្ចូល - រួចរាល់ : ការផលិតខ្សែការពារ ការបញ្ចូលក្តារក្រដាស ដូច្នេះអ្នកអាចជៀសវាងការបំពេញចន្លោះប្រហោងប្លាស្ទិក។

ទំហំត្រឹមត្រូវ។ ៖ គាំទ្រទំហំប្រអប់ខ្លីដែលកាត់ ទំងន់វិមាត្រ នៅពេលដែលប្រអប់មិនអាចជៀសវាងបាន។

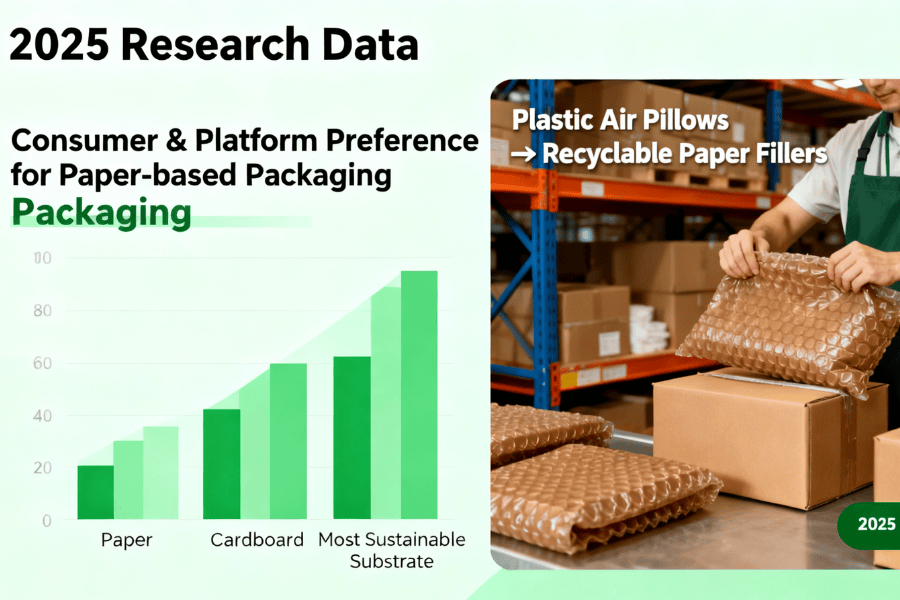

នៅខាងក្នុង Innopack's ម៉ាស៊ីនសំបុត្រ សម្ភារៈដែលយើងបង្កើនប្រសិទ្ធភាព Kraft + សរសៃកែច្នៃ ជាមួយនឹងវិស្វកម្ម បន្ទះក្រដាស (បន្ទះឈើ) សម្រាប់ការពារការធ្លាក់ចុះ។

ការបិទត្រាដោយខ្លួនឯង។ ជាមួយនឹងស្រទាប់ស្រោបជាក់ស្តែង ការជ្រាបចូលងាយស្រួលបើកជាជម្រើស។

ការរចនាសម្ភារៈម៉ូណូ - សម្រួលសម្រាប់កម្មវិធីកែច្នៃឡើងវិញ

ដំណើរការផលិត (ពីគេហទំព័រទៅអ្នកផ្ញើ) ការរៀបចំ និងបង្កើតគេហទំព័រ - សរសៃអំបោះបង្កើតជាបំពង់/ដៃអាវជាមួយនឹងការបញ្ចូលទ្រនាប់។

ការផ្សាភ្ជាប់គែម និងការបង្កើតលឺផ្លឹប - ការផ្សាភ្ជាប់កម្ដៅ ឬស្អិតជាមួយនឹងការគ្រប់គ្រងសីតុណ្ហភាព/សម្ពាធពេលវេលាជាក់ស្តែង។

បញ្ចូលដោយស្វ័យប្រវត្តិ (ជាជម្រើស) - រួមបញ្ចូលមាត្រដ្ឋាន / ចក្ខុវិស័យ; បោះពុម្ពកញ្ចប់ slip/label ហើយបិទ flap ដោយស្វ័យប្រវត្តិ។

បោះពុម្ព/លេខកូដ - ការបោះពុម្ពនៅលើការហោះហើរនៃលេខសម្គាល់ការបញ្ជាទិញ ត្រឡប់ព័ត៌មាន ឬម៉ាកយីហោ។

អ្វីដែលធ្វើឱ្យវាប្រសើរជាង "ធម្មតា" អ្នកផ្ញើសំបុត្រដែលផលិតតាមតម្រូវការ ការផ្លាស់ប្តូរយ៉ាងឆាប់រហ័សក្នុងចំណោមទំហំស្តង់ដារ; គាំទ្រ SKU-to-mailer mapping ដើម្បីកាត់បន្ថយ ឌីម ការពិន័យ។

ការរចនាក្រដាសដំបូង ៖ តម្រឹមនឹងការផ្លាស់ប្តូររបស់វេទិកាធំៗដែលនៅឆ្ងាយពីខ្នើយខ្យល់ផ្លាស្ទិច និងអ្នកផ្ញើសំបុត្រចម្រុះ។

ពេលវេលាដំណើរការខ្ពស់។ ៖ ចំណុចជាប់គាំងតិចជាង ការផ្លាស់ប្តូរទម្រង់ឧបករណ៍តិច និងការភ្ជាប់បណ្តាញដោយស្វ័យប្រវត្តិសម្រាប់ការដំណើរការជិតបន្ត។

ស្លាក + បិទក្នុងសំបុត្រមួយ។ ៖ បង្រួមជំហានការងារ និងធ្វើឱ្យខ្លី កញ្ចប់ទៅកប៉ាល់ វដ្ត។

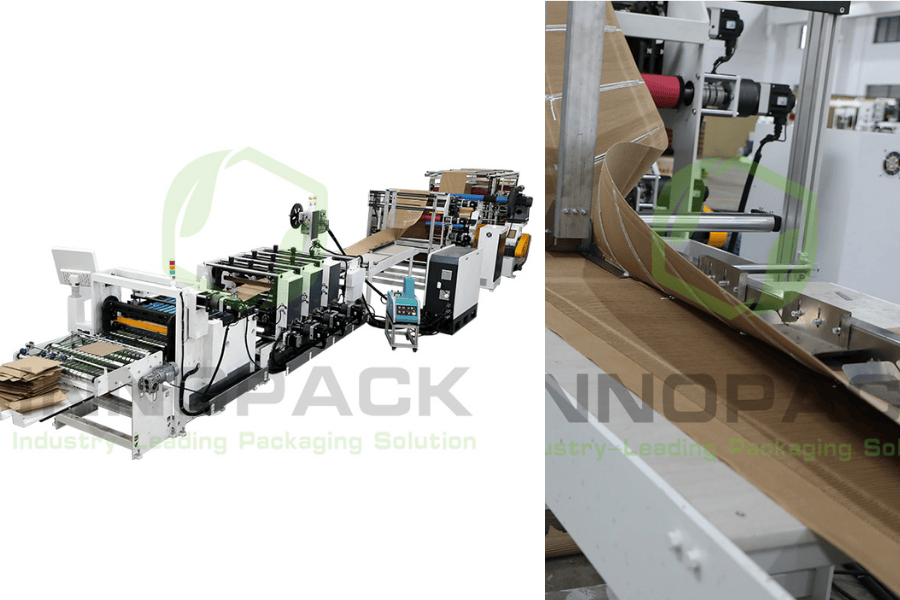

2025 ទិន្នន័យស្រាវជ្រាវ

ការយល់ដឹងពីអ្នកជំនាញ និងវិទ្យាសាស្ត្រដែលប៉ះពាល់ដល់ ROI របស់អ្នកនៅឆ្នាំ 2025 អ្នកប្រើប្រាស់ និងវេទិកាចូលចិត្តការវេចខ្ចប់ក្រដាស។ ការសិក្សាជាច្រើនឆ្នាំ 2025 បង្ហាញពីក្រដាស / ក្រដាសកាតុងធ្វើកេសដែលយល់ថាជាស្រទាប់ខាងក្រោមដែលមាននិរន្តរភាពបំផុត; ទីផ្សាធំៗបានផ្លាស់ប្តូរជាសាធារណៈពីខ្នើយខ្យល់ផ្លាស្ទិច ឆ្ពោះទៅរកឧបករណ៍បំពេញក្រដាស និងប្រអប់សំបុត្រដែលអាចកែច្នៃឡើងវិញបាន។

ការវេចខ្ចប់ទំហំត្រឹមត្រូវ លើសថ្លៃ DIM ។ ក្រុមហ៊ុនដឹកជញ្ជូនគិតថ្លៃដោយ ទំងន់វិមាត្រ ដូច្នេះ ការកាត់ចន្លោះទទេ (តាមរយៈប្រអប់តូច ឬអ្នកផ្ញើសំបុត្រ) កាត់បន្ថយថ្លៃដឹកជញ្ជូន។ ការកំណត់ទំហំត្រឹមត្រូវ និងការប្តូរទៅអ្នកផ្ញើសំបុត្រគឺជាកត្តាដែលបង្ហាញឱ្យឃើញនៅក្នុងប្រតិបត្តិការពាណិជ្ជកម្មអេឡិចត្រូនិក។

ហេដ្ឋារចនាសម្ព័ន្ធស្តារក្រដាសមានភាពចាស់ទុំ។ ក្រដាសនិងក្តារក្រដាសជាប្រវត្តិសាស្ត្រសម្រេចបាន។ អត្រាកែច្នៃខ្ពស់។ ទាក់ទងទៅនឹងសម្ភារៈផ្សេងទៀត គាំទ្រដល់គោលដៅរង្វង់ និងការប្តេជ្ញាចិត្ត CSR ។

អាទិភាពនៃប្រតិបត្តិការ៖ នៅឆ្នាំ 2024-2025 នាយកប្រតិបត្តិវេចខ្ចប់កំពូលបានជាប់ចំណាត់ថ្នាក់ ផលិតភាព ស្វ័យប្រវត្តិកម្ម និងនិរន្តរភាព ជាអាទិភាពឈានមុខគេ - មានន័យថាអ្នកទិញគួរតែអនុគ្រោះដល់ឧបករណ៍ដែលបង្កើន OEE និងកាត់បន្ថយភាពស្មុគស្មាញនៃសម្ភារៈ។

AI និងទិន្នន័យសំខាន់នៅលើបន្ទាត់។ បន្ទះឧស្សាហកម្មរាយការណ៍ថា AI បានកាត់សំណល់អេតចាយ និងវិភាគបញ្ហាចុះឈ្មោះលើដំណើរការបត់/បោះពុម្ព-ករណីមួយដែលបានលើកឡើង ច្រើនលានដុល្លារ ការកាត់បន្ថយសំណល់អេតចាយប្រចាំឆ្នាំ។

កន្លែងដែលម៉ាស៊ីននីមួយៗ ឈ្នះ ជ្រើសរើសម៉ាស៊ីនបត់ នៅពេលអ្នកត្រូវការ៖

សុចរិតភាពនៃរចនាសម្ព័ន្ធ និងការជង់ (ផុយស្រួយ, ធ្ងន់ជាង, ធ្នើលក់រាយ) ។

ការដោះប្រអប់ពិសេស និងការតម្រឹមបោះពុម្ពសម្រាប់ការនិទានរឿងម៉ាក។

ការបញ្ចូល និងភាគថាស ផលិតក្នុងបន្ទាត់ ដើម្បីជំនួសការបំពេញចន្លោះប្រហោងប្លាស្ទិក។

លក់រាយ + អ៊ី-ខម កូនកាត់ កញ្ចប់ដែលប្រអប់នៅតែជាកាតព្វកិច្ច។

ជ្រើសរើស ក ម៉ាស៊ីនសំបុត្រ នៅពេលអ្នកត្រូវការ៖

អ៊ី-com ដែលមានល្បឿនលឿន សម្រាប់សំលៀកបំពាក់ សៀវភៅ គ្រឿងបន្លាស់ គ្រឿងបន្លាស់ D2C។

កញ្ចប់សម្ភារៈ mono-ស្តើង ដើម្បីកាត់បន្ថយ DIM និងសម្រួលការកែច្នៃឡើងវិញ។

ការផ្លាស់ប្តូរលឿន ឆ្លងកាត់ទំហំស្តង់ដារ (S/M/L) ជាមួយនឹងឧបករណ៍តិចតួចបំផុត។

ស្វ័យប្រវត្តិកម្មពីការបញ្ចូលទៅស្លាកដើម្បីបិទ នៅក្នុងលំហូរមួយ។

ប្រតិបត្តិការពិភពលោកពិត និងមតិអ្នកប្រើ ករណីផ្លាស់ប្តូរសម្លៀកបំពាក់ - យីហោម៉ូដមួយបានផ្លាស់ប្តូរ 55% នៃ SKUs ពីកេសទៅ អ្នកផ្ញើក្រដាស . លទ្ធផល៖ ការគិតថ្លៃបន្ថែម DIM តិចជាងមុន ការប៉ះតិចជាងពីរនៅពេលកញ្ចប់ចេញ និង 12% SLA លឿនជាងមុន។

អ្នកបោះពុម្ពសៀវភៅ / អ៊ីរៀន - បានប្តូរទៅប្រអប់ទំហំខាងស្តាំនៅលើប្រអប់ ម៉ាស៊ីនបត់ កាត់បន្ថយការត្រឡប់មកវិញនៃជ្រុងដែលខូច និងសន្សំប្រាក់ 8% ។

អ្នកបើកយន្តហោះ 3PL - 3PL ក្នុងតំបន់បានប្រើបន្ទាត់សំបុត្រជាមួយនឹងការបញ្ចូលដោយស្វ័យប្រវត្តិដើម្បីទ្រទ្រង់ រដូវកាលកំពូល បរិមាណដោយមិនបន្ថែមចំនួនក្បាល; ប្រតិបត្តិករបានសរសើរការផ្លាស់ប្តូរទម្រង់ឧបករណ៍តិចក្នុងរយៈពេលតិចជាង 4 នាទី។

ចំណុចទិន្នន័យវិទ្យាសាស្ត្រ របាយការណ៍ទីផ្សារសំខាន់ៗ 100% ការដកខ្នើយខ្យល់ផ្លាស្ទិច នៅអាមេរិកខាងជើង និង ក ការកាត់បន្ថយ 16.4% YoY នៅក្នុងការវេចខ្ចប់ផ្លាស្ទិចប្រើតែមួយដង ជំរុញដោយ ការវេចខ្ចប់ក្រដាស កូនចិញ្ចឹម។

ទិន្នន័យអាមេរិកបង្ហាញ ក្រដាសនិងក្តារក្រដាស ថែរក្សា អត្រាងើបឡើងវិញខ្ពស់។ ធៀបនឹងសម្ភារៈផ្សេងទៀត។

ការកំណត់ទំហំត្រឹមត្រូវដើម្បីជៀសវាង ទំងន់វិមាត្រ នៅតែជាគន្លឹះដ៏មានប្រសិទ្ធភាពបំផុតមួយដើម្បីកាត់បន្ថយតម្លៃកញ្ចប់នៅក្នុង parcel e-commerce - ច្បាស់ណាស់ដែលជាកន្លែងដែលអ្នកផ្ញើសំបុត្រភ្លឺសម្រាប់ SKUs ទន់ ហើយបន្ទាត់បត់អាចបើកបាន។ ប្រអប់តូចជាង សម្រាប់ទំនិញដែលមានរចនាសម្ព័ន្ធ។

ក្នុង ការស្ទង់មតិឧស្សាហកម្ម អាទិភាពកំពូលសម្រាប់ប្រតិបត្តិការវេចខ្ចប់គឺ ផលិតភាព (65%) , ស្វ័យប្រវត្តិកម្ម (49%) , និង និរន្តរភាព (35%) - ពង្រឹងតម្រូវការសម្រាប់ភាពត្រឹមត្រូវនៃ servo ការផ្លាស់ប្តូររហ័ស និងការរចនាក្រដាសដំបូង។

បញ្ជីត្រួតពិនិត្យការអនុវត្ត សម្រាប់ម៉ាស៊ីនបត់

បញ្ជាក់ថ្នាក់ក្តារ (SBS/FBB/kraft) និង calipers ក្នុងមួយ SKU ។

តម្រូវឱ្យមានរូបមន្តផ្អែកលើ ការកំណត់ទីតាំងដោយស្វ័យប្រវត្តិ សម្រាប់មគ្គុទ្ទេសក៍ / ក្បាលកាវ។

Vision QC សម្រាប់មុំលឺផ្លឹបឭ ការច្របាច់ចេញ និងការផ្ទៀងផ្ទាត់លេខកូដ។

គ្រឿងបន្លាស់ + ការវិនិច្ឆ័យពីចម្ងាយ SLAs; គោលដៅ > 90% ពេលវេលាទំនេរដែលបានគ្រោងទុក .

ផែនទីបង្ហាញផ្លូវសម្រាប់ ការបញ្ចូលក្នុងបន្ទាត់ ការផលិតជំនួសការបំពេញចន្លោះប្រហោងប្លាស្ទិក។

សម្រាប់ម៉ាស៊ីនសំបុត្រ

ចាក់សោទំហំសំបុត្រតាមស្តង់ដារ និងការគូសផែនទី SKU (A/B/C)។

បន្ថែម បញ្ចូលដោយស្វ័យប្រវត្តិ + បោះពុម្ព និងអនុវត្តដើម្បីបង្រួមជំហានចេញកញ្ចប់។

ផ្ទៀងផ្ទាត់ភាពរឹងមាំនៃការផ្សាភ្ជាប់ (peel-and-seal) និងខ្សែរហែកដែលងាយស្រួលបើក។

ប្រភព kraft កែច្នៃមាតិកា និងទ្រនាប់ស្របតាមទីផ្សាររបស់អ្នក។

ផែនការ ការផ្លាស់ប្តូរក្រោម 5 នាទី។ និងការបណ្តុះបណ្តាលប្រតិបត្តិករសម្រាប់ការគ្រប់គ្រងគេហទំព័រ។

ម៉ាស៊ីនបង្កើត Padded Mailer

សំណួរគេសួរញឹកញាប់ តើម៉ាស៊ីនសំបុត្រល្អជាងប្រអប់សម្រាប់ដឹកជញ្ជូនសម្លៀកបំពាក់មែនទេ? បាទ . ក្រដាស អ្នកផ្ញើសំបុត្រ កាត់បន្ថយបរិមាណកញ្ចប់ និងថ្លៃ DIM សម្រាប់ទំនិញទន់ នៅតែអាចកែច្នៃឡើងវិញបាន ហើយការវេចខ្ចប់លឿនដោយការរួមបញ្ចូលការបញ្ចូល ស្លាក និងបិទត្រាក្នុងមួយជំហាន។

តើខ្ញុំនៅតែត្រូវការប្រអប់ និងម៉ាស៊ីនបត់នៅពេលណា? កម្លាំងជង់ ធរណីមាត្រច្បាស់លាស់ ឬវត្តមានលក់រាយ ក ម៉ាស៊ីនបត់ ឈ្នះ - ជាពិសេសសម្រាប់វត្ថុដែលផុយស្រួយ ឬធ្ងន់ជាង។

តើ ROI ខុសគ្នាយ៉ាងណា? សងវិញលឿនជាង សម្រាប់សម្លៀកបំពាក់/សៀវភៅ D2C ដោយសារការសន្សំកម្លាំងពលកម្ម និងការដឹកជញ្ជូន។ ទិន្នផលបន្ទាត់បត់ ការគ្របដណ្តប់ SKU ធំជាង និងការបន្ថែមតម្លៃលក់រាយ។

តើអ្នកផ្ញើក្រដាសពិតជាមាននិរន្តរភាពជាង? អត្រាការងើបឡើងវិញក្រដាសខ្ពស់។ ធ្វើឱ្យការទាមទារប្រកបដោយនិរន្តរភាពកាន់តែងាយស្រួលក្នុងការបញ្ជាក់។

តើខ្ញុំអាចដំណើរការសម្ភារៈកែច្នៃឡើងវិញដោយភាពជឿជាក់បានទេ? សរសៃ PCR កំណត់ទម្រង់កាវ/ម៉ាស៊ីនកម្តៅ និងធ្វើឱ្យមានសុពលភាពអង្គចងចាំ/កម្លាំងត្រានៅក្រោមអាកាសធាតុរបស់អ្នក។

ឯកសារយោង Daniel Nordigården, David Feber, Gregory Vainberg, Oskar Lingqvist ។ ការឈ្នះក្នុងការវេចខ្ចប់ប្រកបដោយនិរន្តរភាពក្នុងឆ្នាំ 2025៖ នាំវាទាំងអស់គ្នា។ McKinsey & ក្រុមហ៊ុន។

McKinsey & ក្រុមហ៊ុន។ តើអតិថិជនអាមេរិកយកចិត្តទុកដាក់ចំពោះការវេចខ្ចប់ប្រកបដោយនិរន្តរភាពនៅឆ្នាំ 2025 ដែរឬទេ?

អាម៉ាហ្សូន។ របាយការណ៍និរន្តរភាព Amazon ឆ្នាំ 2024 ។

Amazon និរន្តរភាព។ ការច្នៃប្រឌិតវេចខ្ចប់។

សហរដ្ឋអាមេរិក EPA ។ ក្រដាស និងក្តារក្រដាស៖ ទិន្នន័យជាក់លាក់នៃសម្ភារៈ។

PMMI 2024 ការផ្លាស់ប្តូរការវេចខ្ចប់ និងដំណើរការប្រតិបត្តិការ។

PMMI Business Intelligence ។ ការបង្កើនប្រសិទ្ធភាពការអនុវត្តឆ្នាំ 2025៖ ការយល់ដឹងសម្រាប់ការត្រៀមខ្លួនជាស្រេចនៃខ្សែវេចខ្ចប់។

ការវេចខ្ចប់ជ្រមុជទឹក។ គំនូសតាង Amazon ធ្លាក់ចុះ 28% នៅក្នុងការដឹកជញ្ជូននៅអាមេរិកខាងជើងដែលមានការវេចខ្ចប់ផ្លាស្ទិចប្រើតែមួយដង។

ប្លុក ShipBob ។ ការវេចខ្ចប់ទំហំត្រឹមត្រូវ៖ វិធីដ៏ឆ្លាតវៃក្នុងការកាត់បន្ថយថ្លៃដើម និងជៀសវាងថ្លៃសេវាទម្ងន់ DIM ។

ការវេចខ្ចប់ ស្រោប។ បង្កើនប្រសិទ្ធភាពការវេចខ្ចប់របស់អ្នកសម្រាប់តម្លៃ Dim Weight។

យោងតាមលោក Dr. Elaine Foster អ្នកវិភាគប្រព័ន្ធវេចខ្ចប់ជាន់ខ្ពស់នៅវិទ្យាស្ថានវេចខ្ចប់សកល "តុល្យភាពរវាងនិរន្តរភាព និងផលិតភាពគឺលែងជាជម្រើសទៀតហើយ វាជាយុទ្ធសាស្ត្រប្រតិបត្តិការ។" ទាំងម៉ាស៊ីនបត់ និងម៉ាស៊ីន Mailer ឥឡូវនេះតំណាងឱ្យចុងពីរនៃបដិវត្តន៍ស្វ័យប្រវត្តិកម្មដូចគ្នា៖ មួយសម្រាប់ភាពជាក់លាក់នៃរចនាសម្ព័ន្ធ មួយទៀតសម្រាប់ប្រសិទ្ធភាពសម្ភារៈ។

ក្រុមហ៊ុនដែលទទួលយកប្រព័ន្ធទាំងពីររាយការណ៍ពីការកាត់បន្ថយកាកសំណល់សម្ភារៈរហូតដល់ 18% និងការបំពេញបានលឿនជាង 30%។ គន្លឹះគឺមិនមែនជ្រើសរើសមួយទេ ប៉ុន្តែការរួមបញ្ចូលទាំងពីរទៅក្នុងប្រព័ន្ធអេកូវេចខ្ចប់ដែលជំរុញដោយទិន្នន័យ។ នៅឆ្នាំ 2025 អ្នកឈ្នះពិតប្រាកដមិនមែនជាម៉ាស៊ីនទេ វាគឺជាក្រុមហ៊ុនផលិតដ៏រហ័សរហួនគ្រប់គ្រាន់ដើម្បីធ្វើជាម្ចាស់ទាំងពីរ។